-

Product Management

Software Testing

Technology Consulting

-

Multi-Vendor Marketplace

Online StoreCreate an online store with unique design and features at minimal cost using our MarketAge solutionCustom MarketplaceGet a unique, scalable, and cost-effective online marketplace with minimum time to marketTelemedicine SoftwareGet a cost-efficient, HIPAA-compliant telemedicine solution tailored to your facility's requirementsChat AppGet a customizable chat solution to connect users across multiple apps and platformsCustom Booking SystemImprove your business operations and expand to new markets with our appointment booking solutionVideo ConferencingAdjust our video conferencing solution for your business needsFor EnterpriseScale, automate, and improve business processes in your enterprise with our custom software solutionsFor StartupsTurn your startup ideas into viable, value-driven, and commercially successful software solutions -

-

- Case Studies

- Blog

Marketplace Liquidity: Why Is It Important and How to Measure It?

When defining metrics that influence marketplace success, experts list a number of them including monthly active users, conversion rate, and gross merchandise volume. One of the metrics experts always point out is liquidity. In this article, we’ll consider:

- Definition of liquidity

- Types of liquidity

- Aspects that influence liquidity

- Ways to measure liquidity

- Ways to increase liquidity

Knowing the liquidity level of your marketplace, you can increase its viability and profits. Ready to find out how high the liquidity is in your marketplace? Let’s start.

What is marketplace liquidity?

Marketplace liquidity is one of the most important metrics that defines the success of your business. Many specialists and organizations have discussed this topic and shared their opinion on what liquidity is. Let’s see some definitions from respectable sources.

Each definition above states that liquidity is about the satisfaction vendors and customers get from using a marketplace. That’s why to make your marketplace successful, you should ensure that both buyers and sellers are satisfied with your platform and can find what they’re looking for. Before we move to measuring liquidity, let’s see how it differs from marketplace to marketplace.

What is liquidity for different marketplaces?

Depending on the type of marketplace and the services it provides, liquidity can be expressed differently. Moreover, it’s important to differentiate buyer and seller liquidity, since both influence the overall success of a marketplace. Here’s how liquidity indicators change depending on the marketplace type.

| Type of marketplace | Examples | Buyer liquidity (search to fill rate) | Seller liquidity (utilization rate) |

|---|---|---|---|

| Product marketplace | Amazon, eBay | Percentage of searches that result in a purchase | Percentage of items that sell out during a specific period |

| Booking marketplace | Airbnb | Percentage of availability requests that result in rented apartments | Percentage of listings booked during a specific period |

| Service marketplace | Uber, TaskRabbit | Percentage of drive/job requests that result in rides/hired professionals | Percentage of drivers/professionals working full-time |

No matter how liquidity is expressed on different platforms, it’s a metric you should track because it shows:

- if your marketplace meets the needs of your customers and if they benefit from using your platform

- how satisfied your marketplace users are

- how the supply and demand sides match on your platform

With this information at hand, you’ll understand how successful your marketplace is and if there’s something you should change to improve its performance. Now that you have a general understanding of marketplace liquidity, let’s see what factors influence it.

Aspects that influence liquidity

Liquidity depends on several factors, and you should be aware of them when running your marketplace. Knowing about these factors, you’ll be able to organize your marketplace performance to increase liquidity.

Factor #1 Marketplace model

There are three types of marketplaces depending on the side that decides to fulfill a transaction.

Double-commit marketplaces are platforms where both the supply and demand sides should agree to cooperate. Let’s consider Upwork as an example. For a transaction to happen, a freelancer and employer should first post their offers. Second, they should find each other and get acquainted with each other’s offers. Finally, they decide if they want to cooperate. The process is quite long, and it’s even longer when one side doesn’t accept an offer right away.

Buyers and sellers on such platforms spend a lot of time looking for appropriate offers, and as a result, the liquidity is lower compared with the following marketplace models.

Buyer-picks marketplaces operate in the following way: suppliers list their offers, and buyers decide if they want to buy a product or service and who they want to buy from. Airbnb is an example of a buyer-picks marketplace. While landlords post available houses and apartments, travelers are the ones who decide where they want to stay. Travelers can compare a number of similar offers, and they have the final word. This marketplace model has a higher liquidity level than the previous because it’s enough for one side to make a choice to proceed with a booking.

Marketplace-picks marketplaces are platforms where customers and service providers don’t choose each other since the matching process on these platforms is automated. Such marketplaces usually offer one kind of service, and customers’ requirements don’t differ much. Uber is an example of a marketplace-picks platform. The Uber system sees every request and automatically matches a driver to a customer. Matching happens within minutes, which increases liquidity dramatically since both the supply and demand sides get what they want fast without taking part in the matching process.

Factor #2 Category concentration

If your marketplace offers products or services in several or even a dozen categories, you need to track the category concentration to improve liquidity. Let’s say you run a service that offers dog walking, pet grooming, and drop-in visits, and the most popular category is dog walking.

When you promote your platform, the majority of people come to order dog walking services. Consequently, the concentration in this category will be the highest, and you’ll get buyers faster. As for the two remaining categories, you might wait a long time and spend a lot of money on marketing before you get the first customers.

To make category concentration work for you, you should focus on categories with the highest demand. By promoting these categories, you’ll be able to increase liquidity as well as decrease the price you pay for customer acquisition.

Factor #3 Density

Density is a geographical factor that directly influences marketplace liquidity. Density is expressed as the number of users in a particular area. To increase liquidity, you should focus on one area and work on acquiring customers there, both buyers and vendors. The more vendors and buyers you have in New York, for example, the greater the choice for both sides, and consequently the higher chances that your customers will benefit from using your platform.

These are the factors that influence liquidity. However, simply knowing what liquidity depends on isn’t enough to decide if liquidity is high in your marketplace. To understand if it’s high or low, you should know how to measure it. We’ll tell you how in the next section.

How to measure liquidity

To measure marketplace liquidity, it’s necessary to track several metrics. Below, we go into detail as to what these metrics are and how to measure them.

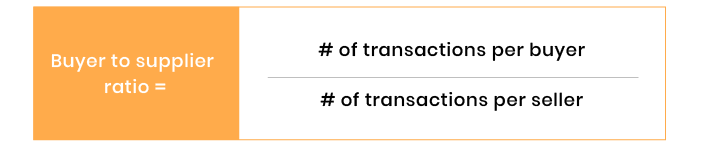

Buyer to supplier ratio

The buyer to supplier ratio shows how many buyers a seller can serve during a particular period. To calculate this ratio, use the following formula:

Depending on the marketplace domain, the buyer to supplier ratio will be different. For example, driving services like Uber will have approximately a 50:1 ratio, while in the real estate industry, this ratio will be closer to 1:1. Knowing this ratio, marketplace owners can balance the supply and demand sides.

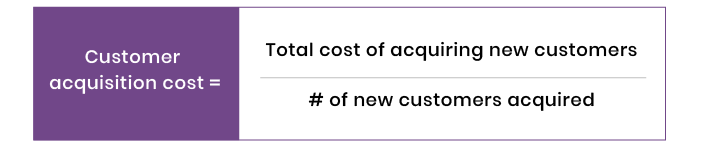

Customer acquisition cost

Customer acquisition cost (CAC) is the price you pay to turn a potential customer into a buyer. To calculate how much money you spend on each new buyer, use the following formula:

The total cost of acquiring new customers can include advertising spending, salaries of your marketing team, and other expenses you direct to customer acquisition. It’s also important to remember to calculate CAC for a certain period — for example, a month or a year.

The customer acquisition cost should be less than the profit brought by each new customer; otherwise, your marketplace liquidity will lower.

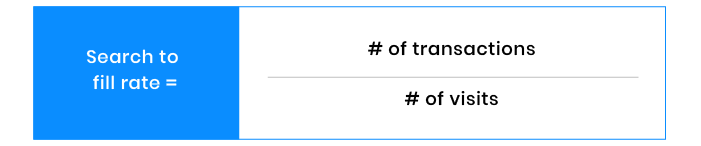

Search to fill rate

Also known as buyer liquidity, the search to fill rate shows what percentage of searches or requests result in a purchase. For different marketplaces, search to fill metrics can be expressed in different ways. For example, for rental platforms like Airbnb and Vacatia, search to fill is the percentage of availability requests that result in bookings.

For TaskRabbit or Thumbtack, it’s the percentage of posted jobs that turn into hires.

For driving services like Lyft, it’s the percentage of ride requests that result in rides.

To calculate this metric, you should divide the number of transactions by the number of user visits during a specific period:

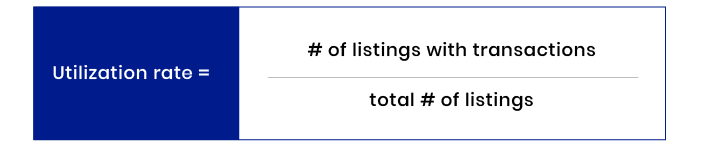

Utilization rate

The utilization rate is the percentage of products or services that suppliers manage to sell or provide during a given period. The higher this rate, the higher the seller liquidity on your marketplace. To calculate this metric, use this formula:

Time to fill

Time to fill is an important metric that helps to measure customer satisfaction and, as a result, marketplace liquidity. The less time it takes buyers to make a purchase or order a service, the happier they are. The same works for vendors who want to sell their products as fast as possible.

There’s no special formula to count time to fill. To find out this metric, you should use time tracking systems inside your marketplace.

You should try to make the time to fill as low as possible since the faster users can find what they’re looking for on your platform, the more satisfied they will be.

By tracking these metrics, you’ll get a deeper understanding of how well your marketplace functions. If you don’t like the metrics you see, you can try to improve them. In the next section, we discuss what steps you can take to improve marketplace liquidity.

How to increase marketplace liquidity

Taking into account that liquidity directly influences the success and profitability of your marketplace, you probably want to know how you can increase this metric. Let’s consider several effective methods.

Choose the supplier-picks marketplace model

We’ve already mentioned that the supplier-picks model has the highest liquidity thanks to the fact that buyers’ requests are met quickly. If you’re just planning to develop your online business, think if you can apply this model. However, you should keep in mind that this model isn’t suitable for all marketplaces and will hardly work with product or booking platforms. But it can work great with services.

When deciding to apply the supplier-picks model to your marketplace, you should remember to control the quality of your suppliers. If you don’t validate the supply side on your marketplace, it can result in poor service and customer dissatisfaction.

Improve the matching mechanism

If the supplier-picks model doesn’t work with your marketplace and it’s impossible to fully automate the matching process, you still should try to improve it. Let’s look at several ways you can do that.

Leverage dynamic pricing

Dynamic pricing is one of the methods Uber uses to encourage drivers to take orders. As its name implies, dynamic pricing (or surge pricing, as Uber calls it) means that prices change depending on certain factors. Prices rise when the demand for cars increases and go back to normal when demand declines. Demand usually rises during rush hour, on national holidays, or because of bad weather.

As for the influence of dynamic pricing on liquidity, it’s the following: In situations when a lack of suppliers is possible, the marketplace encourages suppliers to work by offering more for their services. As a result, liquidity rises as both the supply and demand side

Provide alternatives

It can happen that on your marketplace, buyers can’t find an exact product because it’s out of stock, for example. In order not to lose a buyer in such cases, you can show them a similar product from the same or another vendor. By showing alternatives, you can retain a customer and nudge them to make a purchase.

Introduce a human element

If you can’t fully automate the matching process, you can benefit from implementing human assistance. In double-commit and buyer-picks marketplaces, where it can take a long time for users to make a choice, assistants can help customers make up their minds faster. Moreover, they can influence the matching process by offering the best providers, thus improving customer satisfaction with the service.

For example, Airbnb Plus is a collection of Airbnb listings that have exclusive designs and that hosts make an extra effort to maintain. All apartments and houses on Airbnb Plus are inspected by Airbnb representatives, so travelers can have peace of mind when booking via this service.

Another example of a human touch in the marketplace is Giggster ‒ a booking platform where people can find locations for events such as film shoots and conferences. If visitors are hesitating, they can speak to marketplace representatives in several ways: using a chat option on the website, by filling in a form to get more information about available venues, or by talking to an agent.

Optimize customer acquisition

We’ve already mentioned that acquiring a customer should cost you less than the profit that customer brings to your business. One way to decrease the cost of customer acquisition is to gain customer loyalty. Here are several steps you can take to build a loyal community around your marketplace:

- Implement a ratings and review system that will help users see fair feedback about products and services they order

- Run a referral program to grow your customer base by encouraging customers to use and recommend your marketplace

- Facilitate communication between community members to create an atmosphere of openness and trust

When you manage to build a loyal community, you kill two birds with one stone. First, you increase the possibility of repeat purchases, which means one customer brings you revenue two, three, or even a dozen times. Second, you get brand advocates who are ready to promote your business and recommend it to their friends and family. As a result, your customer acquisition cost drops while the number of customers increases.

Recap

Liquidity is a crucial metric that defines marketplace success. By using the approaches to define and measure liquidity listed in this article, you’ll be able to understand the current liquidity of your marketplace and improve it in the future.

FAQ

-

Marketplace liquidity is a metric that defines how successful your marketplace is and can be explained as the probability that each user on your marketplace, whether on the supply or demand side, can get what they came for.

-

To measure marketplace liquidity, you should calculate five metrics: the buyer to supplier ratio, the customer acquisition cost, the search to fill rate, the utilization rate, and the time to fill. All of these metrics allow you to see how efficiently your marketplace operates.

-

You can increase the liquidity in your marketplace by taking several steps.

- Choose the supplier-picks model when launching your marketplace. This model has the highest liquidity by default.

- If you can’t use a buyer-picks model for your marketplace, try to improve the matching mechanism by using dynamic pricing, providing alternatives to marketplace users, and introducing a human element.

- Optimize customer acquisition so you spend less money on attracting new customers than they bring to your business.

Looking for a reliable marketplace development team? RubyGarage has more than nine years of experience in this field. Tell us about your project to get started!