-

Product Management

Software Testing

Technology Consulting

-

Multi-Vendor Marketplace

Online StoreCreate an online store with unique design and features at minimal cost using our MarketAge solutionCustom MarketplaceGet a unique, scalable, and cost-effective online marketplace with minimum time to marketTelemedicine SoftwareGet a cost-efficient, HIPAA-compliant telemedicine solution tailored to your facility's requirementsChat AppGet a customizable chat solution to connect users across multiple apps and platformsCustom Booking SystemImprove your business operations and expand to new markets with our appointment booking solutionVideo ConferencingAdjust our video conferencing solution for your business needsFor EnterpriseScale, automate, and improve business processes in your enterprise with our custom software solutionsFor StartupsTurn your startup ideas into viable, value-driven, and commercially successful software solutions -

-

- Case Studies

- Blog

Top 7 FinTech Trends to Watch in 2022

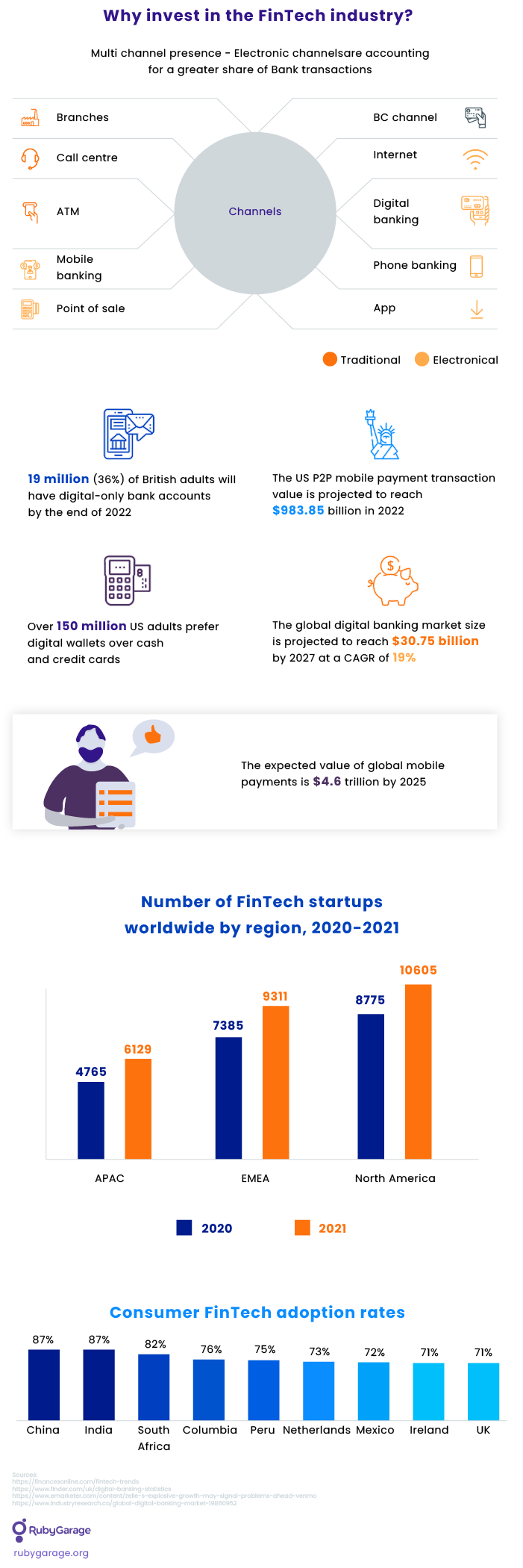

The transportation and travel businesses have been revolutionized by Uber and Airbnb, and the financial sphere is next in line to be completely transformed into a digital, open, transparent, and user-controlled space.

In this article, we look at the seven trends that will have the most impact on each and every aspect of the FinTech sphere in 2022. But before we do this, let’s take a look at the latest stats and predictions concerning the financial sector to see whether investing in FinTech is worth your time and money.

As you can see, the FinTech sphere is growing and can be a gold mine for those who invest in it now. It’s time to find out what trends are going to shape the FinTech industry in 2022 and what branches are going to be the most profitable.

#1 Сlose cooperation between banks and FinTech startups

Nobody is going to be able to do it alone.

Modern online-only banks and young FinTech startups understand that the only way to compete with traditional banks is by providing customers with transparent and clear conditions for cooperation combined with the ability to choose only those features they want.

As a result, traditional banks have felt a massive customer churn, which has encouraged them to form non-traditional alliances and amalgamations with non-banking financial companies. These partnerships are mutually beneficial. Established banks get the technological innovations offered by startups, which help them develop more customer-centric products and provide a better customer experience. Startups, in turn, get support from major financial players to be able to scale.

Here are some examples of fruitful collaboration between established names and FinTech startups:

- The Royal Bank of Scotland (RBS) has partnered with FreeAgent to provide RBS’s small business banking customers access to online cloud accounting software.

- In 2018, Visa started helping European FinTech startups by providing them with fast-track access to its network and $100 million in investment. Now, any FinTech startup can join the Visa Fintech Partner Connect program.

- Deutsche Bank has partnered with Traxpay, a German FinTech company that provides reverse factoring services and discounting for corporate clients. The bank aims to provide clients with innovative supply chain solutions within their own offerings. Thanks to this, Deutsche Bank has become a global leader in supply chain financing.

The growth of bank–FinTech partnerships started a few years ago and is heating up in 2022. According to the latest research from Cornerstone Advisors, nearly two in three banks and credit unions have begun one or more FinTech partnerships since 2019. And 37% of those who haven’t done so yet plan to enter into such a partnership in 2022.

If you want to repeat the success of such companies as Acorns, Coinbase, and Adyen, then check out our 7 lessons to grow a prominent FinTech startup!

#2 Use of big data and AI to provide hyper-personalized services

For many years, marketers have been going on about the benefits of personalized services to attract and retain customers. Big data backed up with artificial intelligence (AI) allows financial organizations to collect, report, and analyze large amounts of data to extract useful insights about customers and their needs.

Modern FinTech startups know and take advantage of the power of personalized services. Here’s what executives from Salesforce, First Direct, Barclays, CYBG, and BBVA think about personalization in the age of big tech.

Banks are now trying to catch up. They’re actively adopting big data and AI not only to extract insights about customers but to create AI-based chatbots and personal assistants to optimize and streamline internal processes, improve risk management, and predict customer behavior. More than that, banks are using AI technology to reduce operating costs. It’s estimated that AI can reduce banks’ operating costs by 22 percent by around 2030, which amounts to about $1 trillion in savings.

The Royal Bank of Scotland, Bank of America, American Express, JPMorgan Chase, Wells Fargo, Capital One, and many other banks already use AI-powered chatbots and personal assistants to help personnel and to communicate with customers and solve their problems. Swedbank’s Nina Web assistant, for example, successfully handles an average of 30,000 conversations with customers per month.

#3 Research-driven product development

Personalisation, combined with data-driven software development will enable consumers to satisfy all of their financial needs – they will possess the power to decide themselves. We’re investing heavily in data science capability and engineering talent to automate, accelerate and increase the accuracy and quality of these decisions.

As we mentioned, FinTech startups have a massive advantage over conservative banks. They can develop only sought-after features and let customers pay only for the functionality they really need.

Barclays is an example of a traditional bank that is trying (successfully) to personalize the customer experience by providing customers with new features developed after in-depth research. The bank thoroughly measures users’ interactions with each new UX update to find out which new features are popular and which aren’t.For instance, Barclays updated its software by adding a feature to show the logos of companies that users have performed transactions with. As a result, customers got a faster and more efficient way to visualize their expenditures. Analysis showed that users liked the feature and wanted to keep it in the app.

Every updated version of the app contains only a few new features. This approach allows users to get used to new functionality at a pace they’re comfortable with.

#4 Mobile payments are becoming mainstream

Just as ATMs revolutionized the financial industry several decades ago, mobile payments are revolutionizing it today. Modern customers are much less reliant on cash. They prefer digital payments and want them to be secure, instant, invisible, and free of charge.

Not long ago, banks had to confirm every online transaction via SMS or a phone call. Today, biometric access control, like fingerprint and face recognition, allow banks to shorten transaction times, enhance security, and reduce costs.

Such convenience makes people trust these new technologies. According to a recent study from Juniper Research, by 2025, the number of unique digital wallet users worldwide will grow to 4.4 billion, up from 2.6 billion in 2020. Mobile wallet users are expected to account for 70% of this growth. This suggests that the mobile payments industry will face a significant infusion of investments in the next few years.

While more and more customers are paying through mobile devices, financial institutions are concerned with how mobile technologies will handle the increased transaction intensity. The industry’s challenge now is providing a reliable, secure shopping experience and handling higher transaction volumes.

Thinking about a great banking app? We’ve compared the best banking apps and made a list of essential features you can add to your project!

#5 Cybersecurity and intensified FinTech regulation

Despite their popularity, digital wallets, biometric access control, and even one-time-password technologies can’t guarantee 100 percent data security. The growing number of data breaches, cyberattacks, and financial fraud schemes have made governments intensify FinTech regulations to protect customers and organizations.

Another aspect of cybersecurity that’s going to get more attention in 2020 is the use of the blockchain. According to CNBC, crypto and blockchain startups raised $25 billion in 2021, which is eight times more compared to 2020. Interest in blockchain and distributed ledger technologies is also reported by Deloitte’s 2021 Global Blockchain Survey. 73% of respondents to that survey believe their organizations will lose an opportunity to achieve a competitive advantage if they do not adopt blockchain technology. According to 80% of respondents, adopting blockchain and digital assets will provide new revenue streams for their businesses.

One of the main obstacles that constrains the adoption of blockchains by financial establishments is the lack of strict unified regulations. We believe that organizations like the R3CEV Blockchain consortium and others will change this in 2022.

#6 Adoption of robotic process automation technology

Robotic process automation (RPA) is a technology (usually a bot) that imitates a person who’s working with a program and performing repetitive and deterministic actions. Such bots are often simple because they only have to perform simple, repetitive tasks with few exceptions.

Financial establishments use RPA technology to onboard customers, verify users, perform security checks, analyze data, create reports, and ensure their software complies with all regulations. RPA allows companies to automate and streamline processes and dramatically reduce operational costs.

Among those actively investing in robotic process automation are global investment banks, insurance & annuity companies, and the global pharmaceutical industry.

#7 Embedded finance

As part of the growing adoption of embedded finance, banking institutions have to adopt Banking as a Service business lines to respond to end users’ expectations. Embedded finance allows users to access financial tools within non-financial applications. Buy now pay later (BNPL) is one of the most popular examples of embedded finance in ecommerce.

The global embedded finance market is forecasted to reach over $138 billion. by 2026, and some analysts predict its growth up to $7.2 trillion by 2030. It will likely be one of the most significant drivers of innovation in the FinTech industry for the next few years.

Recap

The FinTech industry has evolved significantly over the past few years and is continuing to grow fast. The seven trends we’ve listed above will have the most impact on this sphere in 2022. There is no doubt that the FinTech industry will see significant investment in innovation in the next few years that creates favorable conditions for new startups to arise.